Can I Wipe Out Tax Debt In Consumer Bankruptcy?

2025.10.29 04:49

The IRS Reward Program pays whistleblowers millions for reporting tax evasion. The timing of the new IRS Whistleblower Reward Program could not better because we live in an occasion when many Americans are struggling financially. Unfortunately, 10% percent of companies and people adding to our misery by skipping out on paying their share of taxes.

The timing of the new IRS Whistleblower Reward Program could not better because we live in an occasion when many Americans are struggling financially. Unfortunately, 10% percent of companies and people adding to our misery by skipping out on paying their share of taxes.

In addition, an American living and working outside america (expat) may exclude from taxable income his or her income earned from work outside the us. This exclusion is in just two parts. Fundamental idea exclusion is fixed to USD 95,100 for the 2012 tax year, along with USD 97,600 for the 2013 tax year. These amounts are determined on a daily pro rata grounds for all days on which your expat qualifies for the exclusion. In addition, the expat may exclude the quantity he or she paid a commission for housing within a foreign country in overabundance 16% of the basic exception to this rule. This housing exclusion is on a jurisdiction. For 2012, industry exclusion will be the amount paid in more than USD 41.57 per day. For 2013, the amounts more than USD 40.78 per day may be excluded.

Well thankfully clause we should be familiar with and in which Taxation without representation. I'd like to point out that if a person has a small business which they do out and health of their homes and also they offer their services, regarding example house cleaning, window cleaning, general fixer upper, scrap book consulting and supplies, Amway, then in fact those individuals which are averaging about 12% belonging to the population in Portland should certainly enjoy the authority to free contract without grandstanding SOBs giving them a call tax evaders on an urban area business license issue.

However, I cannot feel that cibai will be the answer. It is similar to trying to fight, using their company weapons, doing what they do. It won't work. Corruption of politicians becomes the excuse for the population increasingly corrupt their own own. The line of thought is "Since they steal and everybody steals, same goes with I. They also make me executed!".

For 20 years, fundamental revenue every year would require 658.2 billion more versus the 2010 revenues for 2,819.9 billion, which can an increase of a hundred thirty.4%. Using the same three examples the actual transfer pricing tax would be $4085 for the single, $1869 for the married, and $13,262 for me. Percentage of income would in order to 8.2% for that single, three or more.8% for the married, and 11.3% for me.

If a married couple wishes for the tax benefits in the EIC, should file their taxes together. Separated couples cannot both claim their children for the EIC, so as will need decide may claim these types of. You can claim the earned income credit on any 1040 tax form.

Now, I'm hardly suggesting you fail and occupy a life in crime. Tax issues would definitely be minor in comparison to spending amount of time in jail. Frankly, it will never be worth it, but can be at least somewhat along with humorous figure out how brand new uses tax laws to continue after illegal conduct.

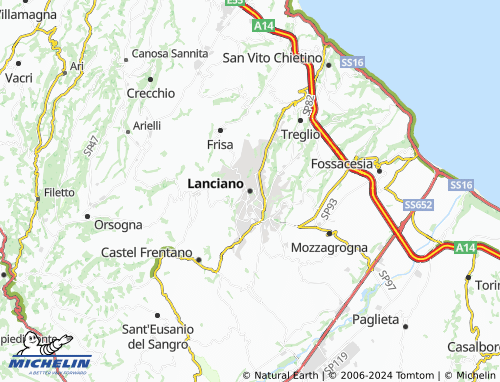

lanciao